Here in DC, we have some of the strongest solar incentives in the country.

Financially, installing solar panels is a slam dunk. In the first year, you can get a tax credit that covers up to 30% of the cost of your system, then you can save tens of thousands more over time with (1) lower energy bills; (2) net metering; and (3) the most generous renewable energy credits in the country.

Which Washington DC solar incentives can you claim? Start by giving us a call at (888) 586-3343, or send us a message anytime. We’re here to help.

Here’s what we’ll cover in the article below:

- Solar Renewable Energy Credits (SRECs)

- Federal and DC Solar Tax Credits

- DC Solar for All Program: Income Eligible Incentives

- Net Metering in Washington DC

- Washington DC Solar Incentives: The Bottom Line

Before jumping in, please note that incentives change, and we’re Washington DC solar installers, not accountants. This page is for informational purposes only and should not be relied on for tax, legal, or financial purposes. Please consult with your accountant, attorney, or other advisors before moving forward with any transaction.

Solar Renewable Energy Credits (SRECs)

SRECs are the key to making money from solar power in DC. They’re certificates that you get for generating solar electricity.

Here’s the thing – DC offers the highest and most stable SREC prices in the nation, and you can cash in your SRECs for thousands of dollars annually from your solar system.

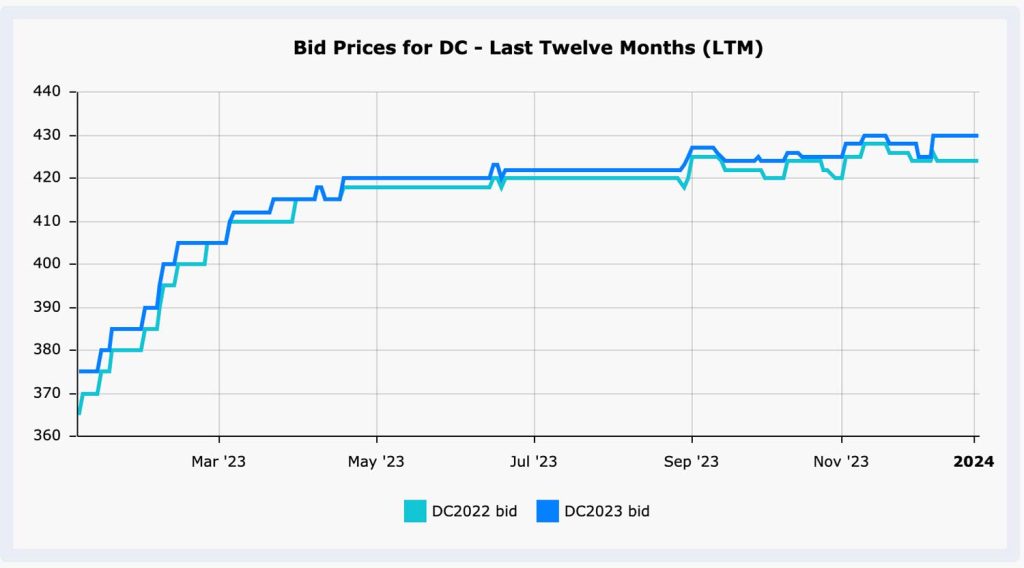

Right now, SRECs are worth more than $400 each (get the latest here), which is double the next best in the country (MA) and five times the average price across the only seven other states that have SREC markets.

If you install an 8 kW solar system that generates 10 MWh of solar electricity annually, you can claim 10 SRECs or more each year. That means an extra $4,000 in your pocket annually or $20,000 over five years in addition to your energy savings and tax credits. We’re talking about serious DC solar incentives.

What Are SRECs, and How Do They Work?

SRECs are created by the local government to encourage more solar power production in DC. The government requires utilities to get a certain percentage of their electricity from renewable sources, and a specific portion of that must come from solar.

This is called the renewable portfolio standard (RPS), and it aims to achieve 100% renewable energy by 2032, with 5% from solar.

As the solar panel owner, you can help utilities meet their RPS goals by generating solar electricity and creating SRECs. You get one SREC for every 1,000 kilowatt-hours (kWh) of solar electricity you produce, which is equivalent to one megawatt-hour (MWh).

For example, if you have an 8-kilowatt (kW) solar system, you can expect to generate about 10 MWh of solar electricity per year, and thus 10 SRECs.

You can then sell your SRECs to utilities or other buyers through the SREC market, which is like a stock exchange for solar certificates. The price of SRECs depends on supply and demand, and it can change daily.

That said, DC has one of the highest and most stable SREC prices in the country, thanks to its ambitious RPS goals and high penalties for utilities that fail to comply.

How Much Can I Earn From SRECs in DC.?

The amount of money you can make from SRECs depends on two factors:

- How much solar electricity you generate, and

- How much SRECs are worth at the time of sale.

The more solar electricity you produce, the more SRECs you create, and the more income you can earn. The value of SRECs, on the other hand, varies based on market conditions and can range from $300 to $500 per SREC.

To give you an idea, let’s assume you have an 8-kW solar system that generates 10 MWh of solar electricity per year, and you sell your SRECs for $400 each. In that case, you can earn $4,000 per year from SRECs alone, or $20,000 over five years.

This is in addition to the savings you get from reducing your electric bill and the tax credits you get from the federal government.

- 10 SRECs×$400=$4,000 in year one

- 50 SRECs×$400=$20,000 over 5 years

Of course, these numbers are just estimates, and the actual earnings may vary depending on the performance of your solar system and the fluctuations of the SREC market.

DC is likely to maintain its high and steady SREC prices in the future, as it has increased its RPS and solar carve-out targets to 10% by 2041. That said, Washington DC solar incentives won’t last forever.

If you’re serious about installing solar panels, give us a call today at (888) 586-3343, or send us a message to get started.

How to Sell SRECs in DC?

If you want to take advantage of the SREC program in DC, you need to own (not lease) your solar system and register it with the local government.

You also need to find a buyer for your SRECs, which can be challenging if you don’t have the time or expertise to navigate the SREC market.

That’s why most solar panel owners use an intermediary service called an aggregator or broker, which acts as a middleman between you and the buyers. Some of the popular SREC aggregators in DC include:

They can help you sell your SRECs at the best possible price, handle the paperwork and transactions, and monitor the market trends.

Depending on what you prefer, you can choose different ways to sell your SRECs through an aggregator. You can sell them on a spot market, where you get the current market price at the time of sale. You can also sell them on a forward market, where you lock in a fixed price for your future SRECs.

Federal and DC Solar Tax Credits

The Federal Solar Investment Tax Credit (ITC) is the other big incentive you should consider.

The ITC is a tax credit that allows you to deduct a percentage of the cost of your solar system from your federal income taxes. This means that you can save money on your solar investment and reduce your tax liability.

Federal Investment Tax Credit (ITC)

The ITC is currently 30% of the cost of your solar system, including equipment, labor, and permitting. This means that if you spend $20,000 on your solar system, you can claim a tax credit of $6,000.

However, the ITC will decrease to 26% in 2033 and to 22% in 2034, and expire in 2035 unless Congress extends it.

To claim the ITC in the current tax year, you need to own your solar system and install it before the end of the year. You also need to file IRS Form 5695 with your tax return and keep the receipts and invoices of your solar purchase.

You can carry over any excess credit to the next year if you don’t have enough tax liability to claim the full amount in one year.

Solar Energy System Property Tax Exemption

One of the benefits of installing solar panels in Washington DC is that you can save money on your property taxes. The Solar Energy System and Cogeneration System Personal Property Tax Credit exempts you from paying any additional taxes on the increased value of your home due to your solar system.

The bottom line – You can enjoy the savings from your solar electricity without worrying about higher tax bills. Pretty sweet, right?

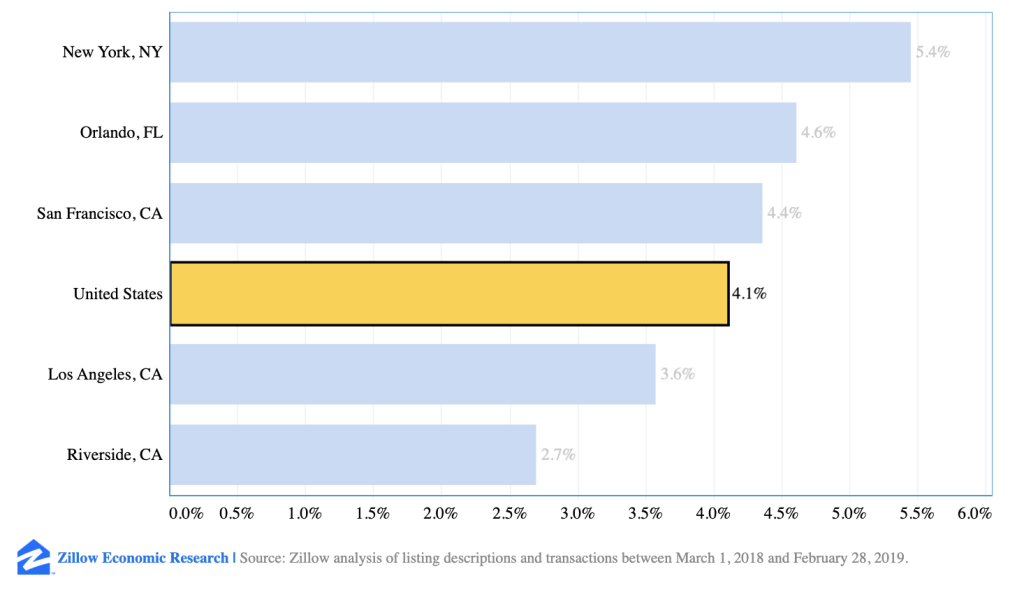

The savings can be significant. According to a survey conducted by Zillow, solar panels boost the average home value by 4%in the U.S. If you own a home worth $500,000 in Washington DC, we’re talking about an extra $20,000 in your pocket when you go to sell.

In this example, you wouldn’t be taxed on the increased property value of your home because of the property tax exemption for DC homeowners.

Homes with Solar Sell for 4.1% More Nationally

If you want to take advantage of the tax exemption, you need to apply for it with the Office of Tax and Revenue. You’ll need to provide proof of your solar system installation, such as a copy of your contract, invoice, or permit.

You will also need to fill out a form that certifies that your solar system is operational and meets the eligibility criteria. You can find the form and more information here.

When you hire EDGE Energy to install your rooftop solar system, we’ll help to make sure you get your property tax exemption. Just give us a call at (888) 586-3343 to get started.

DC Solar for All Program

Solar for All is a program that aims to provide the benefits of solar energy to 100,000 income eligible families in DC. by 2032. The program offers free or discounted solar power to eligible residents, either by installing solar panels on their homes or by subscribing to community solar projects.

By participating in Solar for All, you can save up to 50% on your electricity bill and help the District achieve its clean energy goals.

How to Qualify for Solar for All

To qualify for Solar for All, you’ll need to meet the income guidelines below, based on your household size and income. Please note that guidelines change over time. Click here for the latest.

- $85,200 for 1 person household

- $97,350 for 2 person household

- $109,500 for 3 person household

- $121,700 for 4 person household

- $133,850 for 5 person household

As an alternative to the guidelines listed above, you could also qualify for Solar for All if you receive assistance from one of the following programs: SNAP, TANF, SSI, LIHEAP, or another government assistance program.

If you have question about whether you qualify for the Solar for All program, please give us a call at (888) 586-3343.

Net Metering in Washington DC

Net metering is a policy that allows you to send the excess electricity you generate from your solar panels to the grid and receive a credit on your electric bill. This means that you can use the grid as a backup for your solar system and lower your energy costs.

Net metering in DC is available for solar systems up to 1 MW in size and community solar projects up to 5 MW in size. You can net meter with PEPCO, the main utility in DC. You’ll need a special meter that can measure the flow of electricity in both directions.

How to Benefit From Net Metering in DC

With net metering, you only pay for the net amount of electricity you use from the grid each month. If you produce more electricity than you consume, you get a credit for the excess generation at the full retail rate. This credit will roll over to the next month indefinitely, until you use it up.

For example, if you use 800 kWh of electricity from the grid and generate 1,000 kWh of solar electricity in a month, you will have a net excess generation of 200 kWh. You will get a credit for 200 kWh at the retail rate, which is about $0.13 per kWh in DC.

This credit will be applied to your next bill, reducing your net consumption and saving you money.

- 800 kWh−1,000 kWh=−200 kWh

- −200 kWh×$0.13 per kWh=−$26 credit

DC Solar Incentives: The Bottom Line

We have some of the best solar incentives in the country right here in Washington DC.

You can get a tax credit that covers up to 30% of the cost of your system this year, then save thousands more over months and years with: (1) lower energy bills; (2) net metering; and (3) renewable energy credits – the most generous in the country.

It may seem daunting to navigate all of these programs and incentives. If you hire EDGE Energy to install your solar panels, we’ll guide you every step of the way. We’ve got you covered.